Envisioning the future of tolling

How agencies and operators can create a path to minimize revenue loss

Fifteen to 20 years from now, market saturation of in-vehicle technology will guarantee toll payment at the time of travel, eliminating revenue loss as we know it. In the interim, toll agencies and operators are proactively seeking and implementing solutions to reduce “leakage.” This white paper offers a roadmap to near-term solutions that can help toll agencies achieve their goals.

AET 1.0: The risk-reward trade-off

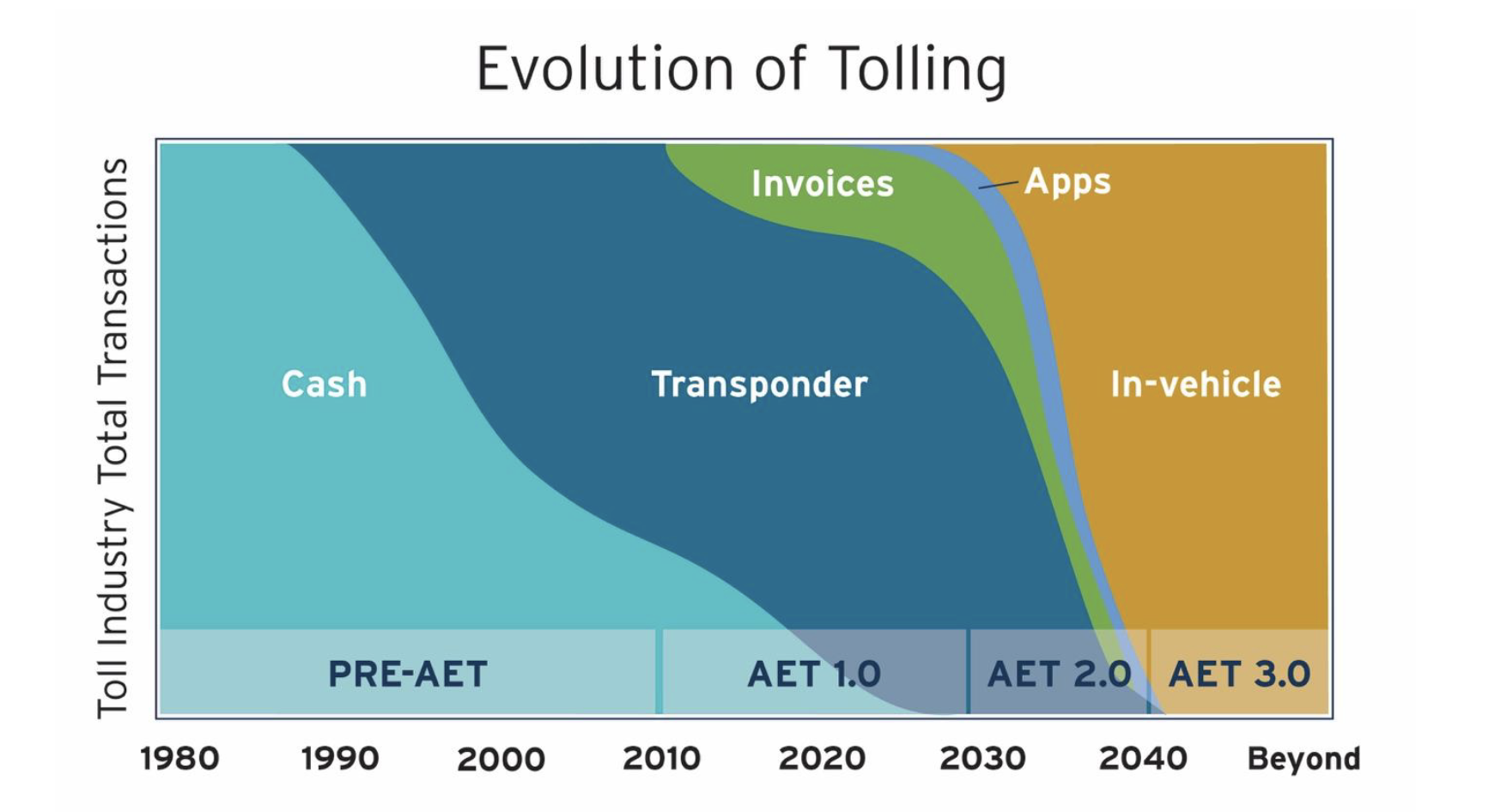

Today, all-electronic tolling is the standard toll collection method in the U.S. But it comes with a price. To fully realize AET’s benefits of greater safety (customers and employees), congestion relief, a cleaner environment, long-term cost reductions and customer convenience, toll agencies sacrifice a certain percentage of revenue, which the industry commonly refers to as “leakage.” Leakage is primarily attributed to the use of license plate-based tolling, particularly the invoicing approach that requires agencies to identify customers after travel, invoice them by mail and then wait for payment.

License plate-based tolling helped get the original version of AET off the ground. It was the next best option for customers who opted not to have a transponder and establish an account, and it became the standard practice, hereby characterized as “AET 1.0.” Unfortunately, today, volumes of mailed invoices often go unpaid. The need to minimize that revenue loss is driving the industry’s evolution to AET 2.0.

In 2020, Mark Compton, Pennsylvania Turnpike Commission CEO and then-president of the International Bridge, Tunnel and Turnpike Association, launched the IBTTA Lost Revenue Task Force to find solutions. The largest industry initiative of its kind, the task force surveyed IBTTA membersand, through its research, distilled the sources of revenue loss under AET 1.0 into four main categories:

1. Unreadable license plate images

2. Unavailable addresses

3. Undeliverable invoices

4. Unpaid invoices — accounting for 60% or more of lost toll revenue annually

AET 2.0: Achieving more efficient revenue collection today

Toll agencies are identifying and quantifying their sources of lost revenue through a process called revenue assurance data mapping. Data mapping is a complete accounting of the disposition of all agency transactions under current toll collection methods. The results form a “you are here” map of where the organization stands in terms of revenue collection efficiency, performance measurements, leakage sources and amounts. The insights allow the agency to create a roadmap to the next generation of AET— what HNTB, as part of the IBTTA task force, has characterized as “AET 2.0.”

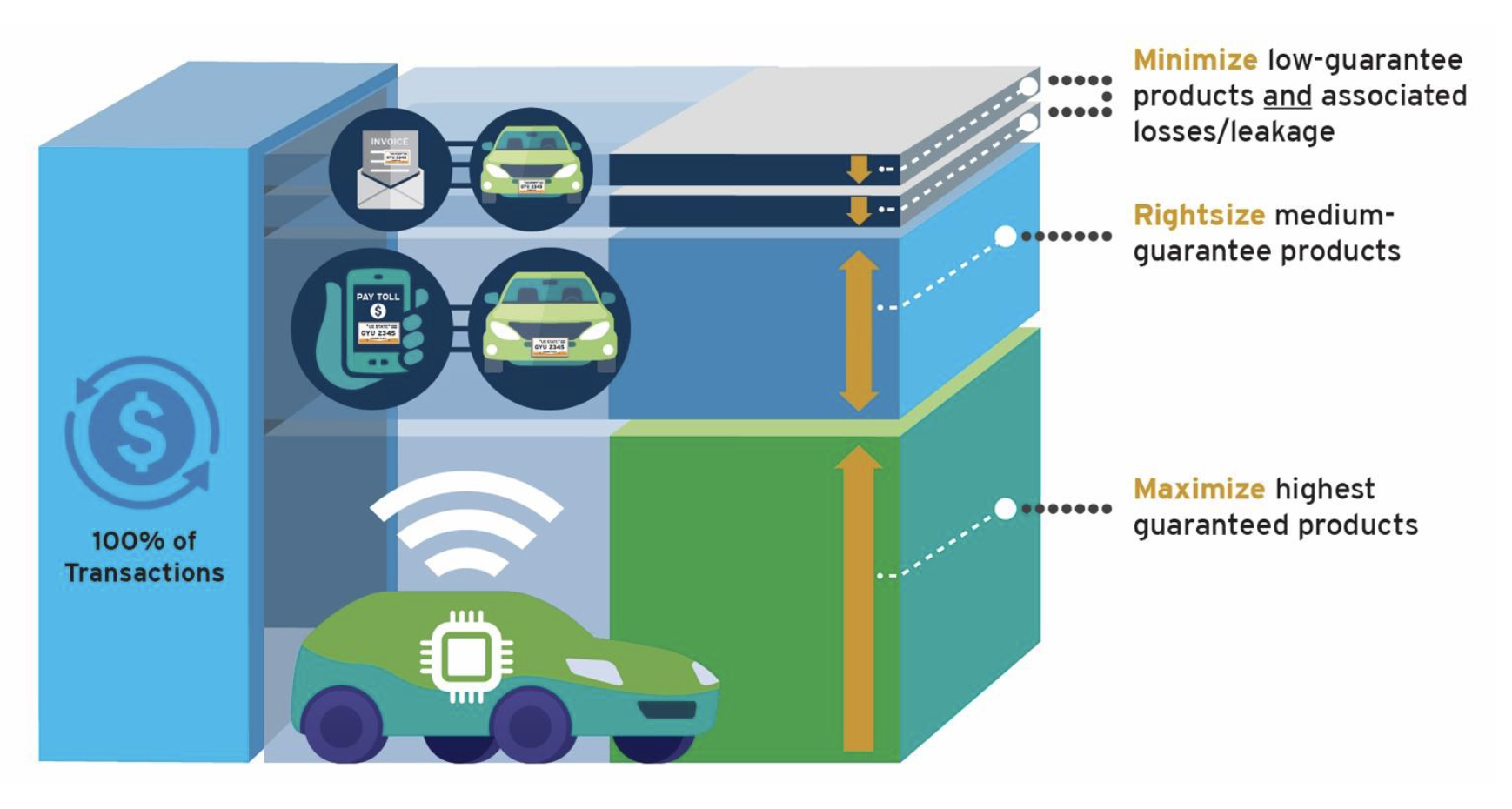

Under the tenets of AET 2.0, a toll agency adopts a customized mix of new market-ready approaches:

- Maximize the use of “high-guarantee” products (aka transponders) to increase revenue collection at the time of travel.

- Minimize the use of “low-guarantee” products, primarily image-based invoicing and all the associated loss points.

- Rightsize the use of “medium-guarantee” products, such as prepaid or preregistered license plate-based toll collection. Commonly done through the toll agency and/or third-party mobile apps, medium-guarantee products help shift customers unwilling to use transponders away from low-guarantee products.

The following questions can help toll agencies determine which product mix is best:

- Should we take a “more is better” approach and offer a broad range of medium-guarantee products to see what works for customers?

- Do we perform more extensive market research to determine which medium-guarantee products to invest in?

- Should we use all our resources to maximize transponder use?

Each toll agency’s approach and product mix will vary according to its size, customer preferences, state and local legislation and political landscape. For example, smaller agencies may want to sell their risk as the Georgia State Road and Tollway Authority is doing. Under the agreement, the third party pays SRTA for a portion of tolls due (converting them to higher guarantee for SRTA) and then assumes the risk of collecting the unpaid invoices and additional fees to cover costs and profit.

In a larger toll agency example, the Pennsylvania Turnpike Commission has effectively begun a partial transition to AET 2.0 with a third-party product that allows non-transponder customers to pay their invoices at popular convenience stores. The goal is to help reduce losses on existing “lower guarantee” invoices. The agency also is expanding its “medium-guarantee” product offering with its own registered license plate tolling app. The app links customer payment options directly to travel and gives the customer a discount, compared with invoiced toll rates. Everyone wins. These initiatives, in addition to a strong retail transponder distribution network, show initial commitment across all tenets of AET 2.0.

The underlying message of the two agency examples above is that each toll agency will have a different path to AET 2.0, but every agency will have the same overall objective of closing revenue gaps.

A sample roadmap to AET 2.0

The following is a hypothetical case study that illustrates how product selection and best practice application can transition a toll agency to AET 2.0.

Let’s say a toll agency already collects revenue from 85% of transactions via transponder accounts. Under AET 1.0, the remaining 15% is collected primarily from post-travel invoices. In a typical situation, if the agency recovers 50% of its invoices, then approximately 93% of total transactions are realizing revenue. Under AET 2.0, the agency would seek to close the 7% gap by implementing the three strategies below.

1. To maximize transponder use (a high-guarantee product), the agency installs multiple protocol systems. Activating multiple protocols allows the widest range of transponder product offerings (from portable hard-case devices to lower-cost fixed sticker tags) to be used on its system. Simultaneously, the agency prices transponder-based transactions to be the most attractive to customers. The agency then polls customers to learn what barriers to transponder adoption remain and enhances current programs to match customer input.

2. To minimize payment by invoice (the lowest guarantee product), the agency calibrates the tolls for invoiced customers to cover the high loss rate and deter use of this most costly payment method. In addition, to make invoice payment even easier for those who are undeterred, the agency offers more online and physical locations where customers can pay their invoices and gives them more ways to pay, including with cash, at those locations.

Second, the agency evaluates the fees and terms of newer payment methods. If these newer products are deemed cost-beneficial, the agency prices them to cover the higher costs. Simultaneously the agency steps up payment enforcement to speed migration to transponder use.

3. To balance transponder use with higher pay-by-plate fees, the agency introduces its own downloadable app and offers other third-party payment and account management apps, so customers have a wide range of service options and pricing. With these additions, customers can register their license plates or establish prepaid license plate-based accounts. This strategy captures the middle market of customers willing to share information —and better yet, payment methods — upfront for a premium price that covers the losses of license plate tolling and the operation of app-based services.

Hypothetically, after implementing all three strategies, the agency could see a 3% overall increase in total revenue (from 93% in AET 1.0 to 96% in AET 2.0). The initiatives boosted transponder use from 85% to 90%, converted 2% of invoiced customers to registered license plate app users and collected the standard half of the remainder (4% of the remaining 8%) via invoice collection. As a bonus, the growth in transponder and app penetration means less revenue is dependent on the time-delayed payment of mailed invoices. So, in addition to having captured more overall revenue, there now is more revenue in the agency’s bank at the time of travel, improving its financial position in both ways.

AET 3.0: The toll collection revolution

Not resting in the moment, toll agencies that implement AET 2.0 to shrink revenue loss can simultaneously begin looking to the long-term future by welcoming the technology, partners and customers of the future: AET 3.0.

Semi-automated and connected vehicles with fixed, in-vehicle communication technology are rolling off assembly lines now. When these vehicles reach market saturation and align with the tolling industry, they will usher in AET 3.0, a world where the limitations and inefficiencies of license plate and even transponder-based tolling are history, just like cash collection.

As one of these new vehicles passes through a toll point, the vehicle’s embedded technology will automatically transmit customer identification and vehicle classification, the standard data of electronic toll collection today, as well as the potential for new information, such as occupancy, customer contact and payment information. Virtually anything needed to handle use-based revenue collection for transportation funding will be available, rendering transponders and license plate-based tolling obsolete. Shades of this future are already here. Implementing prototype AET 3.0 roadside systems side-by-side with existing AET toll collection technology has begun, thanks to collaboration among toll agencies, toll integrators and auto manufacturers.

The toll industry’s path to AET 3.0 could mirror transponder adoption in the 1990s when cash-only toll agencies added equipment to their toll plazas and accepted transponders. As saturation of transponders increased and became the primary payment source, agencies reduced or eliminated cash collections to realize AET’s benefits. Following a similar pattern, agencies could begin accepting fixed, in-vehicle payments in addition to existing AET methods until embedded, in-vehicle technology becomes the primary payment source.

Arriving at the same destination

Fixed in-vehicle toll collection is coming, but it will be another generation (or two) of toll systems and operations before the technology reaches full market penetration. Toll agencies hungry to stem leakage and optimize their AET operations in the meantime don’t have to wait until the technology is prolific to maximize revenues. They can begin to create a path to minimize lost revenue now. Each path will be different, but every toll agency will arrive at the same destination no matter their current product offering

AUTHORS

Kevin Hoeflich, PE | Toll Market Sector Leader, HNTB Corporation

Walter Fagerlund, PE | Lost Revenue Task Force member, IBTTA Director, National Toll Technology Consulting Practice, HNTB Corporation